About Us

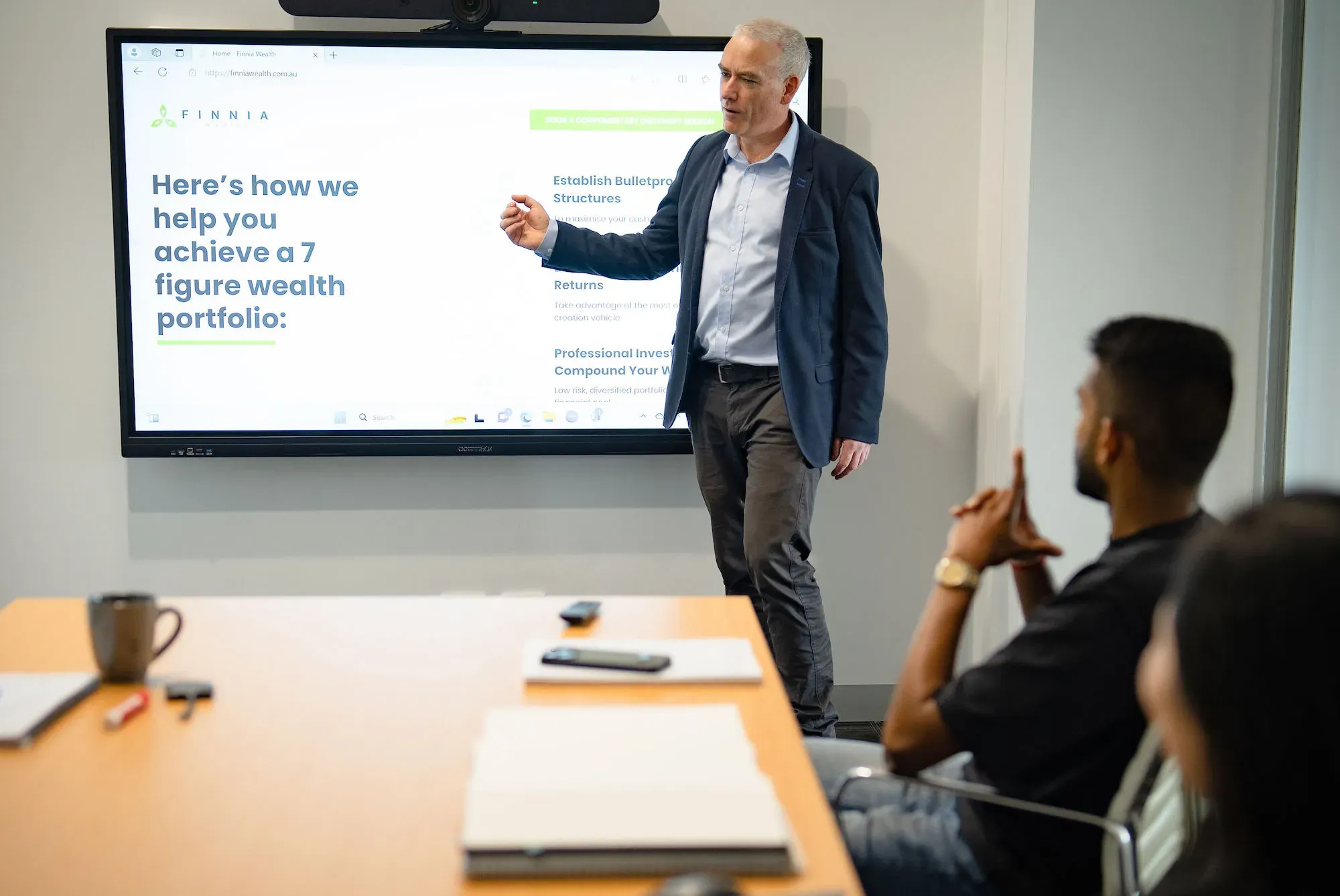

At Finnia Wealth, you and your financial goals take absolute priority.

About John

- Investment Markets

- Cash Flow Management

- Self Managed Super Funds

- Personal Insurance

- Retirement Planning

- Estate Planning

- Debt Management

- Financial Modelling

John likes to understand the needs of his clients’ before building a financial road map to help them achieve their goals. He is a strong believer that advice is not a set and forget. He likes to build a lifelong partnership with his clients so that he can adjust their road map to align with their changing needs.

John Shelton

Finnia Wealth

-

Bachelor of Engineering (Honours) – University of Melbourne

-

Bachelor of Commerce (Honours) – the University of Melbourne

-

Advanced Diploma of Financial Planning – Kaplan

-

Diploma of Financial Planning – Kaplan

-

SMSF – Accreditation

-

Registered Tax Agent for financial advice

The Personalised Approach You’ll Receive with Finnia Wealth

Exceptional financial planning doesn’t happen by accident. It takes a time-tested, relational approach we can provide for you and your family at every turn. Here’s the way we believe sound financial planning should work:

We Believe in Lifelong Partnerships

We Give Flexible,Timely and Realistic Financial Guidance

We Are Seasoned Professionals Who Genuinely Care

Our Seven Step Process to Achieve Your Financial Goals

No two financial situations are the same. We’ll take a deep dive into your entire financial world, which could include the following:

- Your assets and liabilities

- Savings capability

- Personal risk insurance requirements

- Income required for retirement

- Centrelink entitlement position

- And much more!

With a complete understanding of your financial world, we’ll convert your lifestyle requirements into clear financial goals and objectives. You’ll know exactly how much you need to fund your lifestyle now and in the future.

This is where your financial plan comes to life. We’ll meticulously work to develop the strategies you need to meet all your financial goals and objectives.

Your plan is only as good as the assets you need to meet your goals. We’ll determine which assets (i.e. shares, property, bonds, and cash) help you achieve the greatest return.

Every investment under every plan comes with risk. We’ll need to take the time to determine your tolerance to investment risk. Depending on the results and how they match the inherent risk in the asset allocation plan, we may need to close the gap between the two by reaching a compromise. Our goal is to make sure you have the comfort and peace of mind you need to move forward confidently.